Exit Strategy

Exit Strategy – An option or necessity?

As a business owner, one has to continuously evaluate risk and financial losses that might occur over a period of time. But is there a need for a plan to be in place? For example, consider your own house. You will always find two doors both in opposite ends. This is a convention used in construction planning where the second door gives more space for the tenants to exit in case of emergency. Here, having two doors is not just a matter of convenience but also a safety plan and a necessity. How different is your business scenario different than the example of a house? As a business owner, an exit strategy would be last to consider but an essential plan to have in hand before the emergency arises.

A business exit strategy is an entrepreneur’s strategic plan to sell his or her ownership in a company to investors or another company. An exit strategy is a plan that gives a business owner a way to reduce or liquidate his stake in a business and make a substantial profit if the business turns out to be profitable. if the business is successful, make a substantial profit. If the business is not successful, an exit strategy (or “exit plan”) enables the entrepreneur to limit losses. An investor such as a venture capitalist may also use an exit strategy in order to plan for cash out of an investment.

An Exit Strategy has to be built before the initial business plan to take into account important business development decisions. The plan differs from company to company depending on the company’s position, circumstances, market trends, goals and time frame of the business owner. Neglecting to make an exit plan can result in unattained personal and business goals.

There is no one-fits-all template when planning an exit strategy. Although, some factors can contribute to strategizing the exit plan.

Goals

- What do you want to achieve when you leave the business?

- What is the intended time frame?

- Can you be flexible with your exit plan? or

- Do you have a definite plan?

Intentions for the business

- Value is the value of your business?

- Do you want the business to run indefinitely? or

- Do you want it to dissolve?

What's next?

- Do you intend to fund another investment? or

- Are you retiring; or

- Do youwant to just break even and sell out?

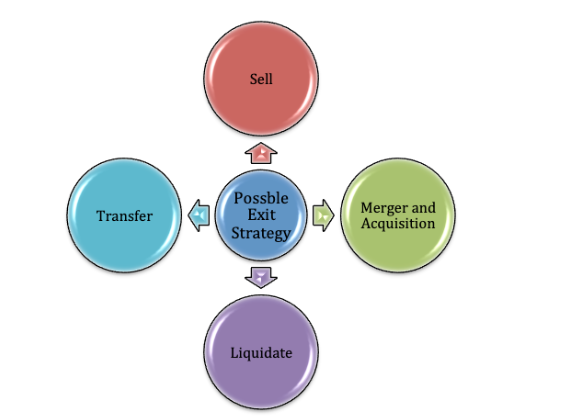

Familiarising with these factors can help to plan the best beneficial exit strategy. This will also help to map out a time frame for the possible exit of your business. Entrepreneurs have many options when deciding how to exit their business, all with different consequences, timelines and preparation processes. The options include:

- Selling the business;

- Merger and Acquisition;

- Liquidate;

- Transfer to partners.

- Selling the business – Entrepreneurs can have many options if they decide to sell out their business. The potential buyers can be anyone from insiders and partners to competitors and strategic, financial or international buyers depending on the company’s position in the market. Deciding on the best option to sell requires evaluating and correctly mapping out the financials of the business and each component of the business. Capital and evidence for earnings growth are essential to successfully sell the business and maximise the profit from the sale.

- Merger and Acquisition – The owner can decide to either merge or get acquired by a company leading to benefiting their own company by increased sales, efficiencies and capabilities. The owner sells his controlling interest but retains the right to involvement under an established contract.

- Merger and Acquisition – The owner can decide to either merge or get acquired by a company leading to benefiting their own company by increased sales, efficiencies and capabilities. The owner sells his controlling interest but retains the right to involvement under an established contract.

- Transfer – Owners often during retirement or planning to leave the current business to start something new may transfer their business to trusted partners, employees or family members. To do this, the succession planning of the business is necessary.

Exit Strategies can vary from business type and size and it can be strenuous to plan out the best-suited plan for your own business and achieve the maximum profit.

We, at IP Active, understand the value of your business and will help you out in maximising the profit by planning out an exit strategy depending on your personal goals. Get in touch today with the IP Active team and be at peace with the plan set in place.